JAMAICA | PNP MP Fitz Jackson Sues Scotia Bank for cheque chashing charge

KINGSTON, July 28, 2022 - Member of Parliament for St Catherine Southern Fitz Jackson has filed a suit in the Supreme Court against the Bank of Nova Scotia Jamaica Limited (Scotiabank) in an effort to prevent banks from illegally extracting funds from their customers and the public at large.

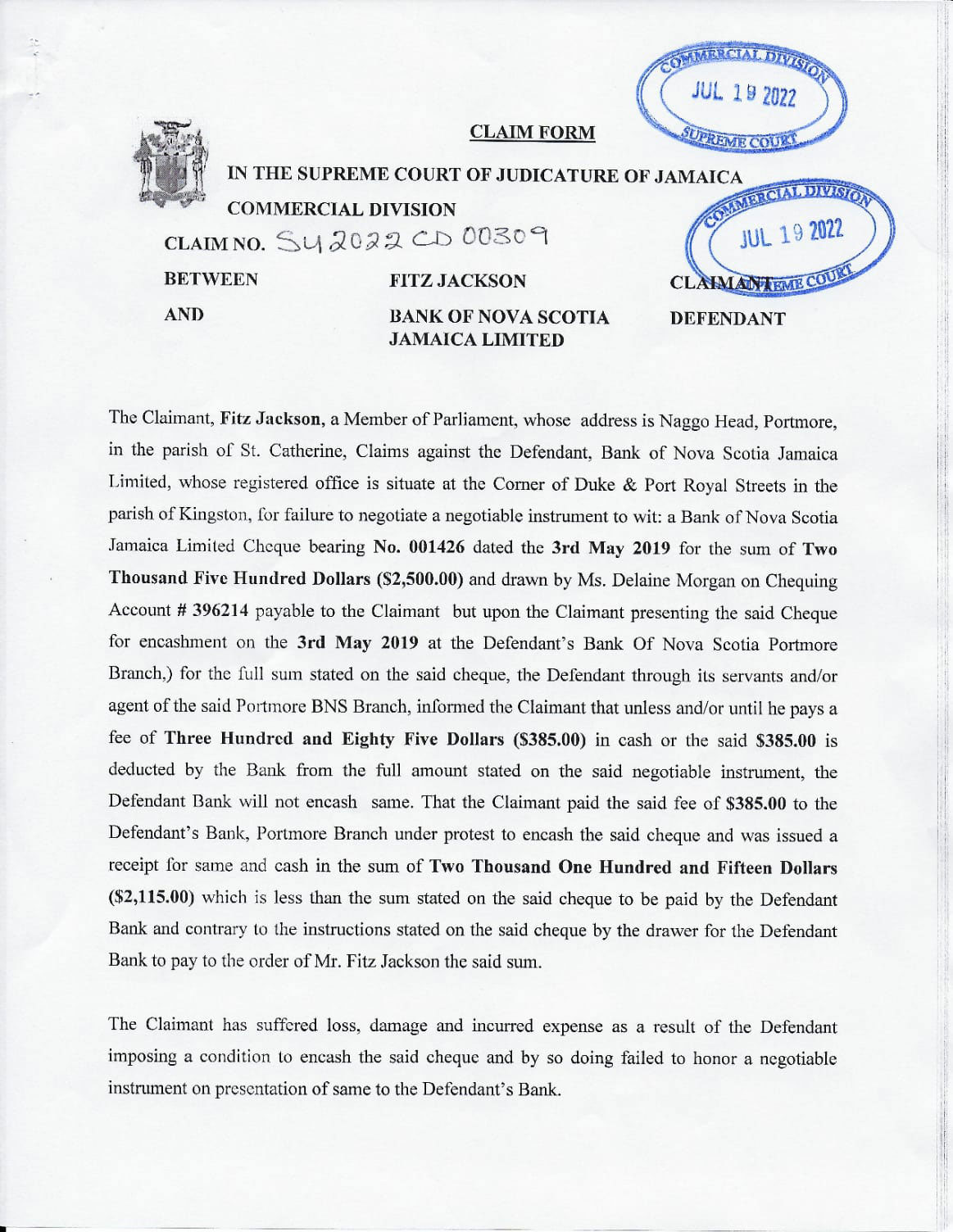

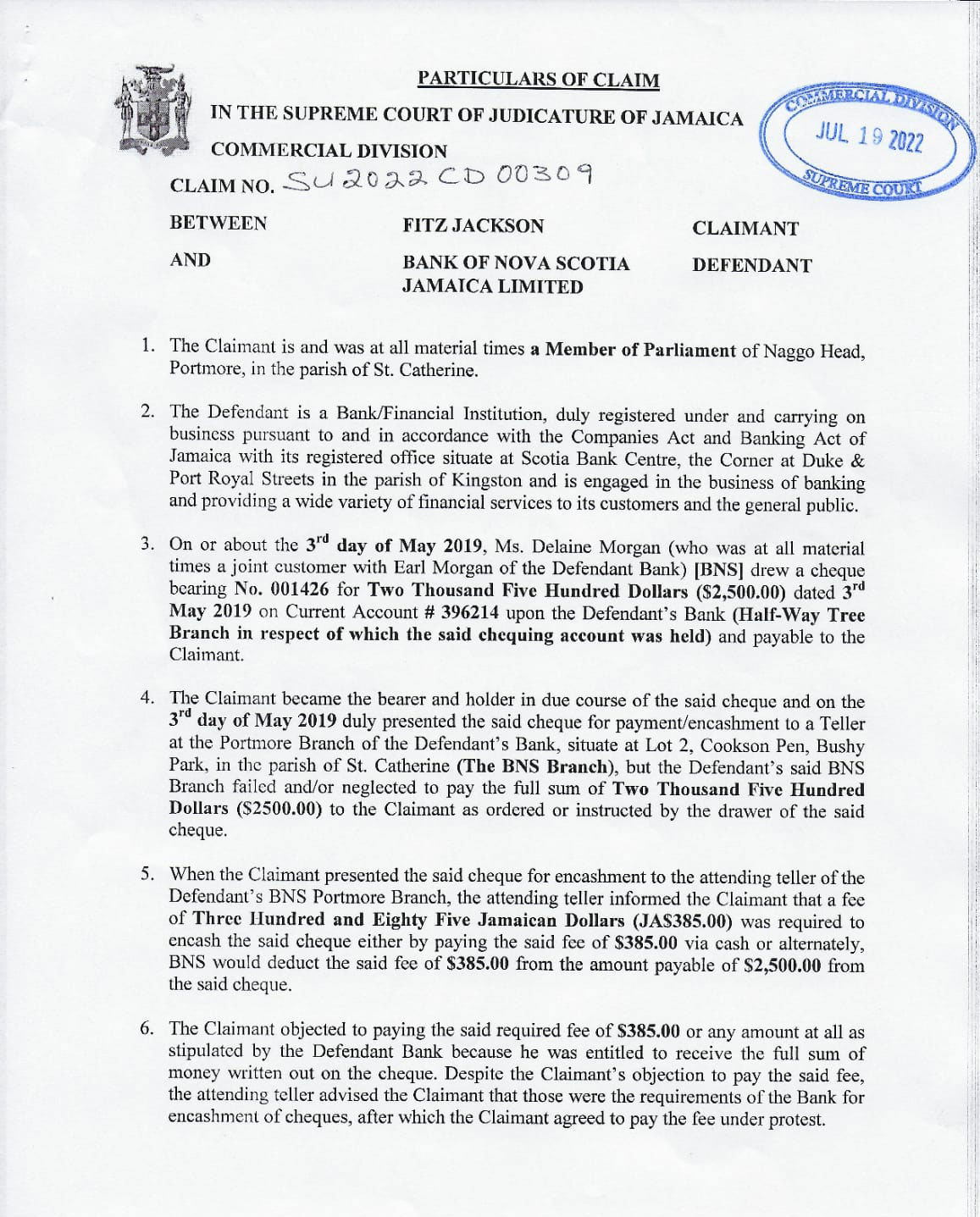

Jackson filed a suit against Scotiabank in the Commercial Division of the Supreme Court on July 19, for charging him a fee of $385 to encash a cheque valued $2,500 on May 3 2019.

“That the Claimant paid the said fee of $385.00 to the Defendant's Bank, Portmore Branch under protest to encash the said cheque and was issued a receipt for same and cash in the sum of Two Thousand One Hundred and Fifteen Dollars ($2,115.00) which is less than the sum stated on the said cheque to be paid by the Defendant Bank, and contrary to the instructions stated on the said cheque by the drawer for the Defendant Bank to pay to the order of Mr. Fitz Jackson the said sum.”

“That the Claimant paid the said fee of $385.00 to the Defendant's Bank, Portmore Branch under protest to encash the said cheque and was issued a receipt for same and cash in the sum of Two Thousand One Hundred and Fifteen Dollars ($2,115.00) which is less than the sum stated on the said cheque to be paid by the Defendant Bank, and contrary to the instructions stated on the said cheque by the drawer for the Defendant Bank to pay to the order of Mr. Fitz Jackson the said sum.”

“The Claimant has suffered loss, damage and incurred expense as a result of the Defendant imposing a condition to encash the said cheque and by so doing failed to honor a negotiable instrument on presentation of the same to the Defendant's Bank,” the court document says.

Jackson is claiming that in charging him a fee to encash a cheque, the bank has breached its fiduciary responsibility as a licensed and regulated financial institution to honour a negotiable instrument, as per the Bills of Exchange Act.

One of Jackson's attorneys, Anthony Williams, told a press conference on Tuesday at Spanish Court Hotel in New Kingston, St Andrew, that "One of the relief sought is a declaratory order," - declaring that the Defendant [Scotia Bank] has breached its obligations as a banker and the drawee of the Cheque by failing to honour a Negotiable Instrument -"So once the court makes that declaratory order then it would certainly have far-reaching implications for other banks because the order will not simply apply to the defendant; it would apply to financial institutions in general…in circumstances of this nature. Once the order is made, other banks will have to comply," the attorney said.

Williams explained that the Bills of Exchange Act is clear and "sets out in very simple language" what is required of banks.

According to Section 3 of the Bills of Exchange Act, "A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a certain sum in money to or to the order of a specified person, or to bearer.

According to Section 3 of the Bills of Exchange Act, "A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a certain sum in money to or to the order of a specified person, or to bearer.

"An instrument which does not comply with these conditions, or which orders any act to be done in addition to the payment of money, is not a bill of exchange," it continues.

Other requirements for a bill of exchange, as outlined in the Act, are that it indicates an account from which payment of funds should be debited, it is dated, it specifies the amount to be paid, and it indicates the place on which the bill is drawn or is payable.

Given the provisions set out by the legislation, Williams argues that Jackson's suit against Scotiabank has legs on which to stand. In fact, he emphasised that the claims of the suit hinge on the words "unconditional order" and "payable on demand".

"Based on our reading and understanding of the Bills of Exchange Act, we're not seeing any provision in the legislation which gives the financial institution the authority to impose a fee," Williams explained.

Jackson, who has been championing the cause of the public against a range of fee charges that have been imposed by many deposit taking institutions, particularly our commercial banks since November 2013, said taking this matter to the court was a "last resort" to protect the interest of the Jamaican people.

However, Jackson said between the Governor of The Bank of Jamaica and Finance Minister Nigel Clarke, who he asked if they had ascertained if such charges were in breach of the Bills of Exchange Act neither of them were forthcoming.

Jackson told a media briefing that: ”the said question was tabled in the House to the Minister of Finance Dr. Nigel Clarke, and to which he provided his response six (6) months later, and not within the 21 days required by the Standing Orders of the House of Representatives.

Jackson told a media briefing that: ”the said question was tabled in the House to the Minister of Finance Dr. Nigel Clarke, and to which he provided his response six (6) months later, and not within the 21 days required by the Standing Orders of the House of Representatives.

“In his response, the Minister said the charges were not in breach of the Bills of Exchange Act. Even in his prepared written response there was clear contradiction of explicit provisions of the said Act.

“When asked if his response was advised by the Attorney General's Chambers, he refused to answer. His clear and persistent refusal to answer, elicited the intervention of the Speaker of the House who urged the Minister to answer the question of whether or not the Attorney General's Chambers informed the answers he provided. The Minister insisted not to answer,” Jackson lamented.

“It is important to note that questions tabled in Parliament to a Minister, are questions to the Cabinet. And the answers provided represent formal and official answers to said questions,” Jackson said.

He went on to inform that ”Given the magnitude and impact of the cheque encashment fee charges to a very wide cross-section of the Jamaican society, I believe it is imperative and urgent that the legality of this practice be settled without any further delay. After consultation with a team of senior members of legal profession, they are of the opinion that the cheque encashment fee charge is a breach of prevailing laws,” Jackson noted.

“With both the BOJ and Minister of Finance, in my view, failing in their respective duties to ensure that the entities for which they have superintendence over, are acting in protection of the public at large, I was left with no other alternative but to directly seek, among other things, a declaration on the legality of the charge from the Court,” the St. Catherine South MP declared.

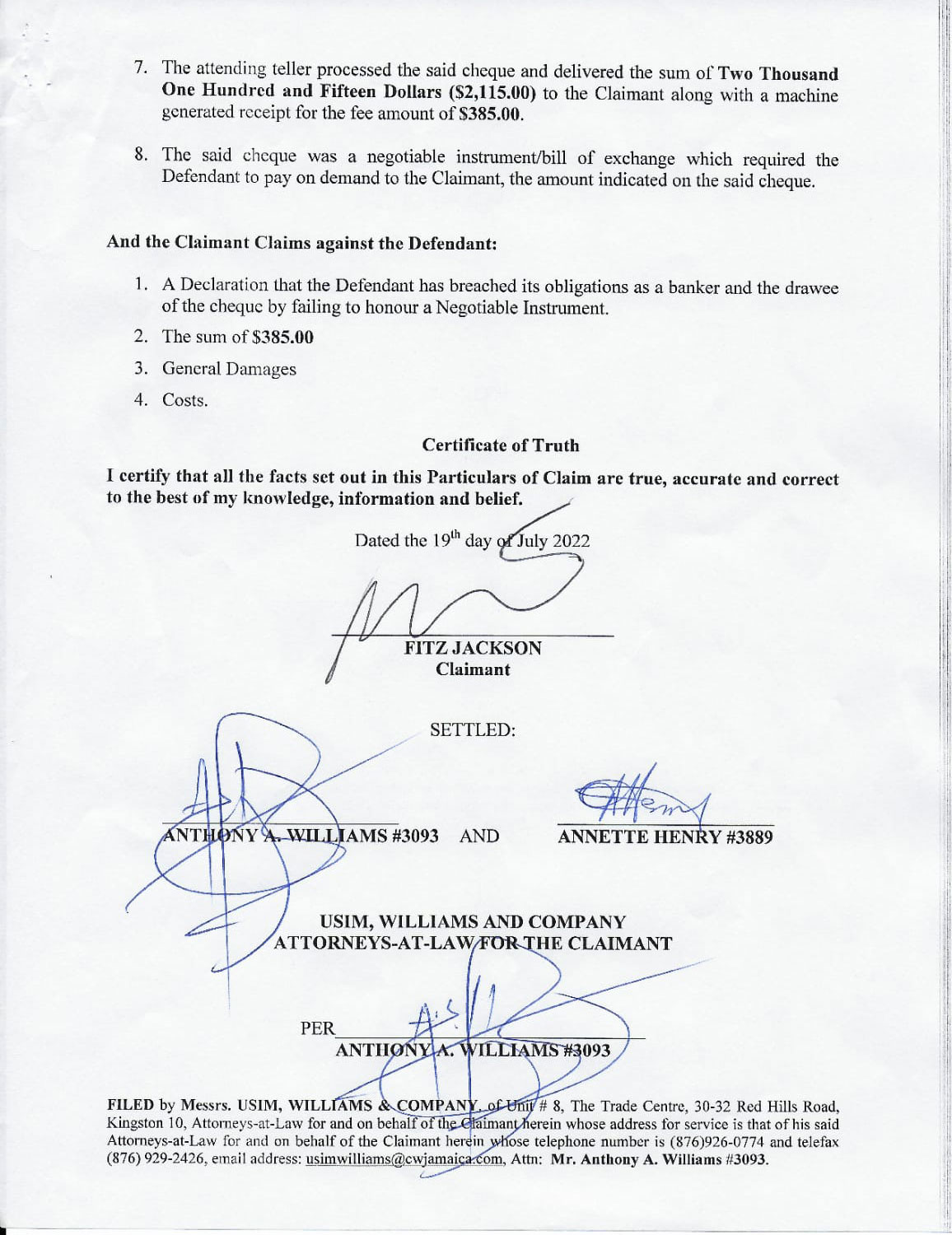

He is asking the court to declare that the Defendant [Scotia Bank] has breached its obligations as a banker and the drawee of the Cheque by failing to honour a Negotiable Instrument; Return his The sum of $385.00; grant General Damages and rule that the Bank should pay the Court costs.

Jackson's November 2013 Private Members Motion that was tabled in Parliament, highlighted a range of fee charges that have been imposed by many deposit taking institutions, particularly our commercial banks. In that Motion, the Bank of Jamaica (BOJ) was asked to do a study of the practice in Jamaica, the region and select international jurisdictions. That was done. A subsequent set of recommendations resulting from extensive consultations with all deposit taking institutions and various stakeholder groups, was submitted through the by-partisan Economy and Production Committee, chaired by Mr. Karl Samuda of the then Opposition to the full House of Parliament, and approved. Those recommendations provided for a Minimum Service Package (MSP) that would allow the face value of depositors’ funds to be protected from erosion by fees being imposed by banks, and for other protections.

MSP provisions: against the imposition of varied charges on transactions from their accounts such as:

- Fee for having deposits for extended periods without using their funds

- Fee for adding more money to their accounts

- Fee for making withdrawals from their account

- Fee for inquiring on transactions made against their accounts

- Fee for cashing cheques paid to them

- Fee for making each withdrawal from their salary payments

- Fee for doing transaction in some banks on Saturdays while the bank is open for general business

- Fee from minimum balance accounts reoccurring until entire balance is eroded

- Fees for many other transactions against their accounts, not involving the banks money

The provisions in the recommendations in the Bill do not apply to fees charged for financial products offered by the banks, i.e., loans, mortgages, overdraft facilities.

As result of no action by the government, the recommendations were contained in a Bill Jackson tabled in late 2017, and debated on February 13, 2018. The government of PM Holness used its majority to defeated the Bill en bloc. The PNP Opposition voted in favour of the Bill en bloc.

"Subsequent to the tabling of the Bill, I later discovered that some fee charges prohibited in the Minimum Service Package, were already in breach of existing legislation such as the dormancy fee and cheque encashment fee charges. Upon making public pronouncements on dormancy fee, and that I would take legal action, within two weeks, all the banks suspended the dormancy fee charges. Note was taken that while they suspended those charges, they never terminated them. Thus, reserving the opportunity to re-impose them surreptitiously, or otherwise," Jackson said.

"As for the cheque encashment charges, I asked of the BOJ at a Standing Finance Committee meeting if they had ascertained if such charges were in breach of the Bills of Exchange Act. The Governor promised to do so and advise. To date, no response is forthcoming, after reminders were made by the Clerk of House, and subsequent reminder directly to the Governor and staff at a PAAC meeting on May 4, 2022. Further to that failure to respond, the said question was tabled in the House to the Minister of Finance Dr. Nigel Clarke, and to which he provided his response six (6) months later, and not within the 21 days required by the Standing Orders of the House of Representatives," Jackson lamented.